Growth capital / Business Angel feature for expanding companies

Participation in MBO / LBO situations

Equity is usually available in tranches of EUR 0.1 to 2 million.

25 years strategic management consulting firm with broad industry know-how

25 years market experience including IPO in domestic and foreign markets

30 years as a legal consultant in business law

30 years M&A experience in the purchase/sale of investments and numerous advisory and supervisory mandates

20 corporate investments since 2002

available private capital EUR 10 million

good contacts to all relevant financial institutions and underwriters

various supervisory and advisory mandates

We hold a maximum of ten active investments simultaneously to ensure optimal support.

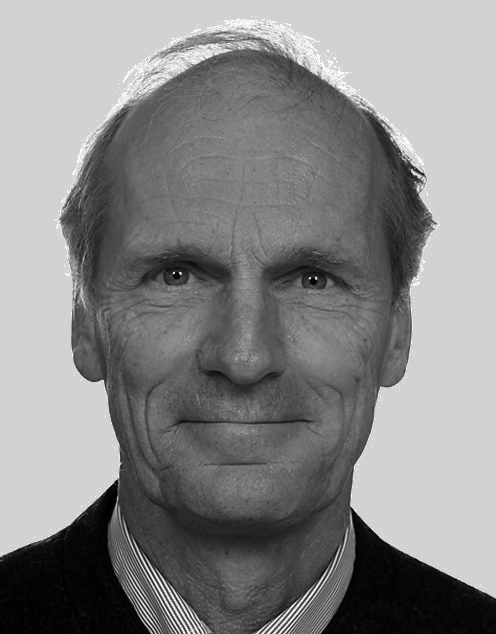

Born 1954, 1972 - 1980 law studies and business administration studies, both at the Universities of Cologne, Freiburg, Stuttgart and Berkeley

1981 doctorate OEC with an M&A topic.

1981 - 1984 Head of Controlling in an engineering company with EUR 250 million yearly turnover.

1984 - 1994 management consultant at Boston Consulting Group, active in the Munich office and 1989/90 New York. Areas of expertise:

- M&A, strategy, controlling, MIS, shareholder change

- Consumer goods, light industry, services, trade,

- Medium-sized companies up to EUR 3 billion revenue.

Since 1988 project manager, since 1992 managing director and partner of the Boston Consulting Group, also head of the German best practice group for corporate development.

Since 1993 own consulting company for asset management, advice for young entrepreneurs, investment and corporate controlling.

(Minority) investments in young companies in the IT area..

Accompanied numerous IPOs as an advisor and member of the board of directors.

Consulting on numerous corporate acquisitions and sales.

Clear definition of the customer's problem (market)

Advantages of the approach compared to alternatives (competition)

Technical feasibility of the solution

Assessment of growth, profitability and required resources (business plan)

Securing key human resources

Securing of financial resources

Construction of market entry barriers (patents, trademarks, know-how, time ...)

Management and organization

Vision +10 years (personal and company-related), exit strategy

Legal, tax, etc.

You are a convincing manager and shareholder/founder

You have clear goals

You have a business plan with balance sheet, P&L for the next three years, with a profit planned from the second year

You have been active for at least two years (exceptions possible)

You offer us a minimum participation of 10% (preferably 20 - 30%)

You plan a yearly growth of over 25% in turnover, 50% in yield

Commercial and legal know-how

Financing know-how up to IPO

Network of partners

International experience